In the competitive and fast-paced trading industry, a robust lead funnel is essential for consistently attracting and converting high-value clients, such as hedge funds, proprietary trading firms, and retail brokers. A well-structured funnel guides prospects from initial awareness to long-term partnerships, ensuring a steady pipeline of opportunities. By focusing on strategic outreach, nurturing relationships, and aligning with client needs, businesses can build a lead funnel that drives sustainable growth.

Understanding the Trading Lead Funnel

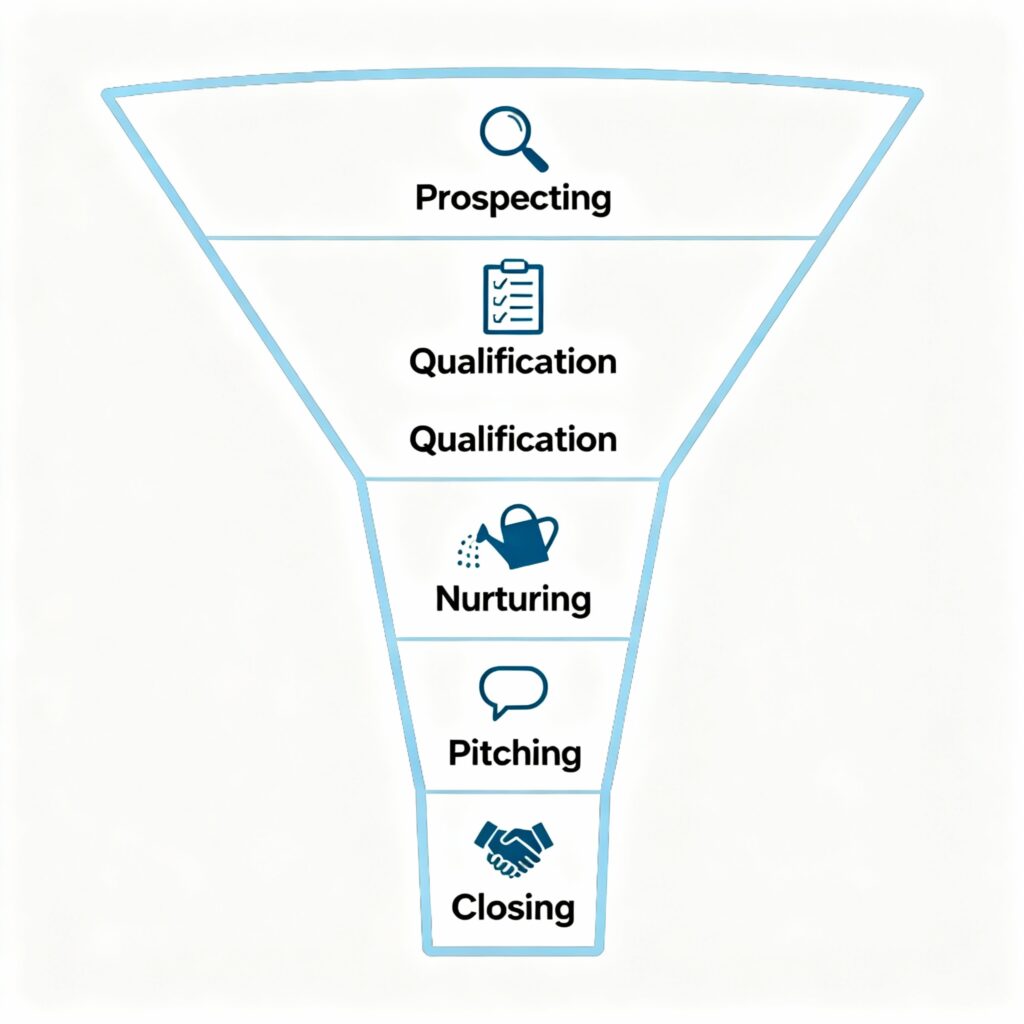

A lead funnel is a structured process that moves prospects through stages: awareness, interest, consideration, conversion, and retention. In the trading industry, where clients are discerning and decisions carry high stakes, each stage requires tailored strategies to address unique needs, such as low-latency execution, compliance, or scalability. Understanding the funnel’s structure helps you engage prospects effectively and guide them toward becoming clients.

Step 1: Creating Awareness

The first stage of the funnel is generating awareness among potential trading clients. These prospects—whether institutional investors or high-frequency trading firms—may not yet know your business or recognize their need for your solutions. To capture their attention, focus on visibility and relevance.

- Industry Presence: Participate in trading conferences, webinars, or industry forums to showcase your expertise. Speaking engagements or panel discussions can position you as a thought leader.

- Content Marketing: Share valuable content, such as whitepapers or market trend analyses, that addresses client pain points like regulatory changes or performance optimization. Tailor content to specific segments, such as compliance insights for institutional investors or latency solutions for HFT firms.

- Referrals and Networks: Leverage existing clients or industry contacts for referrals. A recommendation from a trusted peer can significantly boost your visibility.

By establishing a strong presence, you attract prospects who are likely to align with your offerings, setting the foundation for a robust funnel.

Step 2: Generating Interest

Once prospects are aware of your business, the next step is sparking their interest by demonstrating value. Trading clients are ROI-driven, seeking solutions that enhance performance, reduce costs, or mitigate risks. Engage them with targeted, value-driven interactions.

- Personalized Outreach: Craft messages that address specific client needs. For example, highlight how your solution improves execution speed for proprietary traders or ensures compliance for hedge funds.

- Educational Content: Offer webinars or case studies that showcase how your solutions solve real-world trading challenges. For instance, share a case study of how a retail broker improved client retention with your platform.

- Initial Consultations: Provide one-on-one discussions to explore prospects’ challenges and goals. This shows your commitment to understanding their unique needs.

These efforts build interest by showing prospects how your solutions align with their priorities, moving them further down the funnel.

Step 3: Facilitating Consideration

In the consideration stage, prospects evaluate your solutions against their needs and compare you to competitors. Trading clients prioritize factors like performance, scalability, integration, and cost. To stand out, provide compelling evidence and tailored experiences.

- Tailored Demonstrations: Offer demos that showcase how your solution addresses specific pain points, such as seamless integration for IT teams or robust analytics for portfolio managers.

- Proof of Value: Share performance metrics, client testimonials, or case studies that quantify benefits, like reduced latency or cost savings. This builds confidence in your ability to deliver ROI.

- Stakeholder Engagement: Address the needs of all decision-makers—traders, IT teams, and compliance officers—by providing clear documentation, such as technical specs or compliance assurances.

As outlined in our companion article, Prospecting and Lead Generation for Trading Clients, nurturing leads with personalized, value-driven interactions is critical to keeping them engaged during this stage.

Step 4: Driving Conversion

The conversion stage involves turning interested prospects into clients. Trading firms often have complex decision-making processes, so closing the deal requires addressing concerns, aligning stakeholders, and demonstrating reliability.

- Clear Proposals: Provide detailed proposals that outline costs, implementation timelines, and expected outcomes. Be transparent about limitations to build trust.

- Pilot Programs: Offer trials or phased implementations to reduce perceived risk. For example, a proprietary trading firm may appreciate a pilot to test latency performance.

- Stakeholder Alignment: Facilitate discussions or workshops to ensure all decision-makers—traders, IT, and compliance—are aligned on the solution’s benefits.

By addressing concerns and proving your solution’s value, you increase the likelihood of securing commitments.

Step 5: Ensuring Retention and Advocacy

A strong lead funnel doesn’t end with conversion—it extends to retaining clients and turning them into advocates. Trading clients value ongoing support and long-term value, as downtime or underperformance can lead to significant losses.

- Robust Support: Offer 24/7 technical assistance and regular performance reviews to ensure your solution continues to meet client needs. Proactive support builds trust and loyalty.

- Continuous Value: Provide updates or enhancements that improve performance or address new challenges, such as regulatory changes. This reinforces your solution’s ROI.

- Encouraging Advocacy: Satisfied clients can become powerful advocates. Encourage them to share testimonials or refer you to their networks, feeding new leads into the funnel.

Retaining clients and fostering advocacy ensures a sustainable pipeline by generating repeat business and referrals.

Measuring and Optimizing the Funnel

A strong lead funnel requires continuous monitoring and refinement. Track key metrics, such as lead volume, conversion rates, and time to close, to assess performance. Analyze which strategies—content marketing, personalized outreach, or industry events—drive the most success and allocate resources accordingly.

Gather feedback from prospects and clients to identify areas for improvement. For example, if prospects drop off during the consideration stage, enhance your demonstrations or address integration concerns more clearly. This iterative approach keeps your funnel effective and aligned with client expectations.

Conclusion

Building a strong trading lead funnel requires a strategic, client-centric approach that guides prospects from awareness to advocacy. By creating visibility, sparking interest, facilitating consideration, driving conversion, and ensuring retention, you can build a sustainable pipeline of high-value clients. For more on effective prospecting, explore our related article, Prospecting and Lead Generation for Trading Clients. In the high-pressure trading industry, a well-structured lead funnel is the key to driving growth and fostering lasting partnerships.